How I Navigated Financial Risk Before Moving Abroad — A Pro’s Reality Check

Moving to a new country isn’t just about packing bags—it’s about protecting your financial future. I’ve been there, standing at the edge of a life-changing move, unsure if my money would follow safely. From hidden transfer risks to underestimating living costs, the gaps can sink your plans. This is how I assessed every financial threat, step by step, with real strategies that worked. No jargon, no hype—just the honest breakdown I wish I’d had earlier. The truth is, even careful savers can find themselves financially vulnerable when relocating. It’s not enough to have savings; you need a structure that survives the transition. What follows is a clear-eyed look at the real financial risks of moving abroad and how to manage them with confidence and control.

The Hidden Cost of Starting Over: Why Immigration Is a Financial Leap

Relocating to another country is often romanticized as a fresh beginning—a chance to reinvent oneself in a new culture with new opportunities. But behind the postcard images lies a financial reality few discuss: immigration is one of the most disruptive economic decisions a person can make. It forces a complete reset of your financial ecosystem. Income streams may pause or vanish, credit history becomes irrelevant, and assets that were once liquid can suddenly feel out of reach. For many, the assumption is that savings will carry them through, but without a strategic framework, even substantial funds can erode quickly in a foreign environment.

Consider the professional who earns a strong salary in their home country. They may have a well-established job, a mortgage paid down over years, and retirement accounts growing steadily. Yet upon arrival in a new nation, none of those advantages transfer automatically. Banks do not recognize foreign credit scores. Employers may not value overseas qualifications without re-certification. Even basic services like renting an apartment or securing a phone contract can be delayed by the lack of a local financial footprint. These barriers create immediate pressure on personal finances, often leading to reliance on credit cards or short-term loans—both of which come with high costs when income is uncertain.

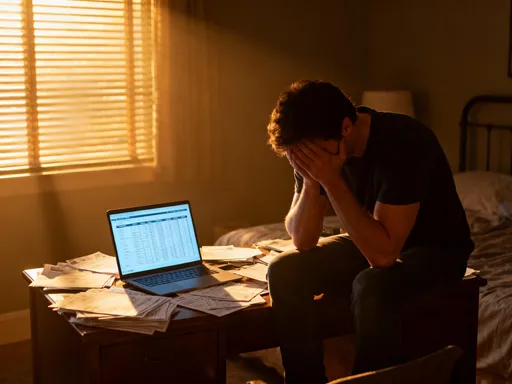

The emotional weight of this disruption cannot be overstated. Leaving behind a stable financial life brings anxiety, especially for those supporting families. There is a psychological toll in starting from zero, compounded by the fear of failure. This emotional burden often leads to poor financial decisions—such as overspending to maintain a sense of normalcy or rushing into unsuitable jobs just to generate income. These choices, while understandable, can undermine long-term stability. The key is recognizing that immigration is not simply a change of address; it is a financial leap that requires preparation, patience, and a clear understanding of what is truly at risk.

Real-world examples underscore this point. A software engineer from India relocated to Canada with $60,000 in savings, believing it would last at least a year. Within eight months, the funds were nearly depleted—not due to luxury spending, but because of unexpected legal fees, higher-than-anticipated rent, and the cost of retraining to meet local certification standards. Similarly, a teacher from South Africa moved to the UK expecting to find work quickly. After five months of job searching, she had to borrow money from relatives to cover basic expenses. These stories are not outliers; they reflect a common pattern. Without proactive planning, even high earners can face cash-flow crises shortly after arrival. The takeaway is clear: financial security abroad begins long before the flight departs.

Mapping Your Financial Exposure: What You’re Actually Risking

Before any international move, it is essential to conduct a thorough audit of your financial exposure. This means identifying every asset, liability, and income source and assessing how each will be affected by the transition. The goal is not to eliminate risk—this is impossible—but to understand it fully so that informed decisions can be made. Many people focus only on the visible costs of relocation: airfare, shipping, deposits. But the deeper risks lie in how financial systems differ across borders and how those differences can impact your long-term stability.

Currency volatility is one of the most significant yet overlooked exposures. When you transfer money from your home country’s currency to that of your new residence, exchange rates can fluctuate dramatically in a short time. A favorable rate today could turn unfavorable by next month, potentially erasing thousands of dollars in value. For example, someone converting a lump sum from USD to EUR might gain or lose 5% or more depending on market movements. This risk is amplified if the transfer is delayed or done in a single transaction. Understanding these dynamics allows for better timing and strategy in moving funds.

Tax liabilities present another major area of exposure. Many countries tax residents on their global income, meaning you may still owe taxes in your home country even after leaving. At the same time, your new country may impose taxes on incoming funds or future earnings. Without proper planning, this can lead to double taxation—a situation where the same income is taxed in two jurisdictions. While tax treaties exist between some nations to prevent this, they are not universal, and compliance requires careful documentation and reporting. Failing to understand these rules can result in penalties, audits, or even legal complications.

Retirement benefits and pension plans also require special attention. In many cases, these accounts cannot be accessed or transferred internationally without restrictions. Some countries impose penalties for early withdrawal, while others limit how much can be moved across borders. Additionally, contributions made over decades may not continue to grow at the same rate in a new economic environment. For instance, a retirement fund invested in domestic bonds may lose relevance if the investor no longer resides in that country. Planning for continuity—whether through rollovers, conversions, or alternative savings vehicles—is crucial.

Rebuilding credit is another challenge that directly impacts financial access. In most countries, credit history does not transfer internationally. This means that even if you had an excellent credit score at home, you will start with no rating in your new country. Without credit, securing a mortgage, car loan, or even a rental agreement can be difficult. Some nations require local employment history or a co-signer, further delaying financial independence. The solution lies in early preparation—opening secured credit cards, establishing banking relationships, and understanding local credit reporting systems before arrival.

Finally, property ownership and insurance rules vary widely. In some countries, foreigners face restrictions on buying real estate or must pay additional taxes. Health insurance may not be publicly funded, requiring private coverage that can be expensive. Understanding these local regulations ahead of time prevents costly surprises. The process of mapping financial exposure is not about fear—it is about empowerment. By seeing the full picture, you can build a strategy that protects your wealth and supports a smooth transition.

Income Gaps and Job Transitions: Planning for the Downtime No One Talks About

One of the most underestimated aspects of moving abroad is the gap between departure and stable employment. Even highly skilled professionals often face delays of several months before securing a job in their new country. This period of unemployment creates a direct threat to financial stability, especially when living costs are high. Unlike temporary layoffs, immigration-related income gaps are predictable—and therefore manageable—if planned for in advance. The key is to calculate a realistic survival budget and ensure sufficient funds are available to cover it.

Job market entry barriers are numerous and vary by profession and country. Licensing requirements may necessitate additional exams or supervised practice periods. Language proficiency, even in English-speaking nations, can affect employability in customer-facing roles. Professional certifications earned abroad may not be recognized, requiring retraining or accreditation processes that take time and money. For example, a nurse from the Philippines may need to pass the NCLEX-RN exam and complete a bridging program before practicing in the United States. These steps, while necessary, extend the period without income.

To prepare, individuals should estimate their monthly expenses in the new location with precision. This includes rent, utilities, groceries, transportation, health insurance, and any mandatory fees. It is wise to add a buffer of at least 20% to account for unexpected costs. Once the monthly figure is determined, multiply it by the expected job search duration—typically three to six months for skilled workers, longer for regulated professions. This total becomes the minimum emergency fund needed before relocation.

For a family of four moving to Australia, where average monthly living costs range from $5,000 to $7,000 AUD, a six-month cushion would require $30,000 to $42,000 AUD in liquid savings. This is not an optional luxury; it is a financial necessity. Without it, individuals may be forced to take jobs below their skill level, delay children’s education, or rely on debt—choices that can have long-term consequences. Building this fund takes time, but it is far better to delay a move than to arrive unprepared.

Beyond savings, alternative income sources can help bridge the gap. Remote work arrangements, if permitted by visa regulations, allow individuals to maintain ties with employers back home. Freelancing in fields like writing, design, or consulting can generate supplemental income while searching for full-time roles. Passive income streams—such as rental properties, dividend-paying investments, or digital products—can also provide steady cash flow without requiring daily effort. These options do not replace a full salary, but they reduce pressure on savings and maintain financial momentum during the transition.

The psychological benefit of having an income bridge should not be ignored. Financial stress can impair job search effectiveness, leading to rushed decisions or diminished confidence in interviews. Knowing that basic needs are covered allows individuals to be more selective and strategic in their career choices. It also gives time to adapt to a new culture, improve language skills, and network effectively—all of which increase long-term employability. Planning for income gaps is not pessimistic; it is prudent. It transforms uncertainty into a manageable phase of the relocation journey.

Currency and Capital Transfer: Protecting Your Money in Motion

Transferring money across borders is one of the most vulnerable moments in the immigration process. It is not simply a matter of logging into a bank account and initiating a wire transfer. International fund movements are subject to exchange rate fluctuations, transaction fees, regulatory limits, and reporting requirements. Without careful management, a significant portion of your savings can be lost before it even reaches your new account. The goal is not to maximize gains but to minimize losses and ensure funds arrive securely and efficiently.

Exchange rate risk is the most volatile factor. Currencies fluctuate daily based on economic indicators, political events, and market sentiment. A transfer made at the wrong time can result in receiving 5% or more less than expected. For someone moving $100,000, this could mean a loss of $5,000 or more. To mitigate this risk, it is advisable to monitor exchange rates over time and avoid making large transfers during periods of high volatility. Using tools like rate alerts or forward contracts—where a favorable rate is locked in for a future date—can provide protection against sudden drops.

Transaction fees are another hidden cost. Banks and money transfer services often charge multiple layers of fees: a flat transfer fee, a percentage-based charge, and a poor exchange rate margin. These can add up quickly. For example, a bank might advertise “low fees” but apply an exchange rate that is 3-5% worse than the mid-market rate, effectively charging a hidden premium. Comparing services like traditional banks, online platforms (e.g., Wise, Revolut), and specialized currency brokers can reveal significant savings. In many cases, non-bank providers offer better rates and lower fees, especially for larger amounts.

Staggering transfers is a practical strategy to reduce exposure. Instead of moving all funds at once, consider spreading the transfer over several months. This approach, known as dollar-cost averaging in investing, smooths out the impact of exchange rate swings. If rates improve, you benefit; if they worsen, you avoid locking in a single bad rate. It also provides flexibility—if plans change or costs are lower than expected, you retain control over how much money enters the new country.

Regulatory considerations must also be addressed. Many countries impose limits on how much money can be transferred without additional documentation. Large inflows may trigger anti-money laundering checks or tax inquiries. To avoid delays, it is important to declare the purpose of the transfer (e.g., “funds for immigration and living expenses”) and keep records of the source of funds. Some nations require proof of legal earnings, such as tax returns or employment records. Being transparent and organized prevents complications with financial institutions or government agencies.

Finally, timing matters. Economic conditions in both the home and host countries influence transfer efficiency. If the home currency is weakening, it may be better to move funds sooner rather than later. Conversely, if inflation is rising in the destination country, holding onto funds in a stronger currency might preserve purchasing power temporarily. Staying informed about macroeconomic trends allows for more strategic decision-making. Protecting your money in motion is not about speculation—it is about discipline, planning, and using reliable methods to safeguard what you have worked so hard to build.

Tax Tangles: Avoiding Double Liability and Compliance Traps

Tax obligations do not end when you leave your home country, nor do they wait to begin in your new one. The moment of transition creates a complex web of responsibilities that, if mishandled, can lead to penalties, audits, or legal issues. Tax residency is determined by factors such as physical presence, intent to stay, and local laws—not just citizenship. This means that even if you are no longer living in your home country, you may still be considered a tax resident for part of the year. Similarly, your new country may tax you on worldwide income from the day you arrive.

Double taxation is a real risk. Without a tax treaty between the two countries, the same income could be taxed twice—once in the source country and again in the country of residence. While many nations have agreements to prevent this, the rules are not automatic. You must actively claim relief by submitting forms, providing proof of foreign taxes paid, and maintaining accurate records. Failure to do so means overpaying—a burden that drains resources unnecessarily.

Reporting requirements are another critical area. Many countries require residents to disclose foreign financial accounts, investments, or property holdings. The United States, for example, mandates the Foreign Bank Account Report (FBAR) and Form 8938 for certain overseas assets. Other nations have similar rules under automatic exchange of information agreements like CRS (Common Reporting Standard). Not declaring these holdings—even if no tax is owed—can result in fines or scrutiny.

Capital gains tax is often overlooked during relocation. Selling assets such as property, stocks, or businesses before moving may trigger a tax liability in the home country. Some jurisdictions treat emigration as a “deemed disposal,” meaning you are taxed as if you sold all your assets at market value on the day you leave. This can create a large, unexpected tax bill. Planning ahead—such as timing sales to fall within lower tax brackets or utilizing exemptions—can reduce or eliminate this burden.

The solution lies in early consultation with cross-border tax professionals. These advisors specialize in international tax law and can help structure your move to minimize liabilities. They assist with determining tax residency status, filing requirements in both countries, and claiming treaty benefits. Their expertise is not a luxury; it is a safeguard against costly mistakes. Investing in professional advice before the move pays dividends in compliance, savings, and peace of mind.

Building a Safety Net from Scratch: Insurance, Credit, and Local Systems

Arriving in a new country without access to healthcare, emergency funds, or credit can turn minor setbacks into major crises. Yet many immigrants overlook the importance of rebuilding a safety net from the ground up. Unlike in their home country, where systems were familiar and accessible, everything must be learned anew. Understanding how local institutions work—banks, insurers, government programs—is essential for long-term financial health.

Healthcare is often the most urgent concern. In countries without universal coverage, private insurance is mandatory and can be expensive. Even where public healthcare exists, there may be waiting periods before eligibility. During this gap, a medical emergency could result in devastating bills. Securing short-term private coverage upon arrival is a prudent step. Researching providers, understanding what is covered, and comparing plans ensures protection without overspending.

Credit rebuilding takes time but can begin immediately. Opening a local bank account is the first step. Some banks offer starter credit cards with low limits that report to credit bureaus. Making small purchases and paying them off on time builds a positive history. Becoming an authorized user on someone else’s account (if permitted) can also help. Over time, this establishes credibility with lenders and enables access to better financial products.

Government assistance programs vary widely. Some countries offer integration support, language training, or employment services for newcomers. Others provide temporary housing aid or childcare subsidies. Learning what is available—and how to apply—can ease the transition. Financial literacy programs, often offered by community organizations, help immigrants understand local banking practices, budgeting, and consumer rights.

The key is proactive engagement. Waiting until a crisis occurs to seek help is risky. By building relationships with local institutions early, immigrants gain confidence and control. This foundation supports not just survival, but long-term success.

The Long Game: Aligning Your Assets with a New Economic Reality

Immigration is not a short-term relocation; it is a generational shift that requires a long-term financial perspective. Once immediate needs are met, the focus must turn to wealth preservation and growth in a new economic environment. This involves reassessing investment portfolios, understanding local market dynamics, and aligning financial goals with new realities such as inflation rates, interest environments, and regulatory frameworks.

Investments that performed well in the home country may not be suitable abroad. Tax implications, currency risk, and accessibility must be evaluated. For example, holding foreign stocks in a country with strict capital controls may limit liquidity. Similarly, real estate investments in the home country may become difficult to manage remotely. Diversifying across geographies can reduce risk, but it requires careful coordination to avoid overexposure.

Inflation and interest rates differ significantly between countries. A savings account that earned 2% at home might earn 5% in the new country—or none at all. Understanding these differences helps in choosing appropriate vehicles for cash reserves, from high-yield accounts to government bonds. Long-term investments should reflect the risk tolerance and time horizon of the household, adjusted for the new economic context.

Estate planning also requires attention. Wills, beneficiary designations, and power of attorney documents may not be recognized across borders. Creating new legal documents that comply with local laws ensures that assets are distributed according to wishes. This is especially important for families with members in multiple countries.

The ultimate goal is sustainable financial integration. This means balancing attachment to the home country with commitment to the new one. It involves making deliberate choices about where to invest, how to save, and when to let go of outdated financial habits. Wealth growth may be slower initially, but with patience and planning, stability can be achieved. The smartest financial move in immigration is not the fastest—it is the one that lasts.

Stability Before Status—Why Risk Assessment Comes First

True financial success in immigration is not measured by how much you bring with you, but by how well you protect it. The allure of a new life can overshadow the practical steps needed to sustain it. Yet without a solid financial foundation, even the most promising move can unravel. By confronting risks early—currency volatility, income gaps, tax complexities, and systemic differences—you create a structure that supports lasting security. This is not about fear or hesitation; it is about foresight and responsibility.

The journey of financial adaptation does not end at arrival. It evolves with every decision, from opening a bank account to planning for retirement in a new system. Each step builds confidence and resilience. The most successful immigrants are not those who move the fastest, but those who plan the most thoroughly. They understand that stability precedes status, and security enables opportunity. By assessing risk with clarity and courage, you lay the groundwork for a future that is not just possible—but prosperous.